Understanding your Council Tax bill

We send out Council Tax bills once a year, in early March, or when you first move in to a property. Your bill shows who is responsible for paying and how much you need to pay.

We have taken a sample Council Tax bill and explained the main elements, to help you make sense of your bill. We have split the bill into three parts to make it easier for you to view.

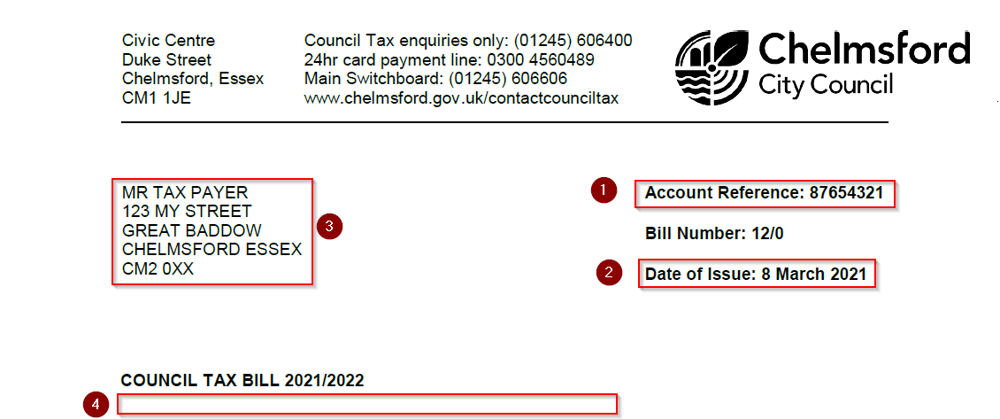

1. This is your Council Tax account number. You need to provide this to us every time you want to speak to us about your account.

2. This is the date we produced the bill.

3. This lists who is responsible for the bill and their correspondence address.

4. If the bill relates to a different property, the address will show here.

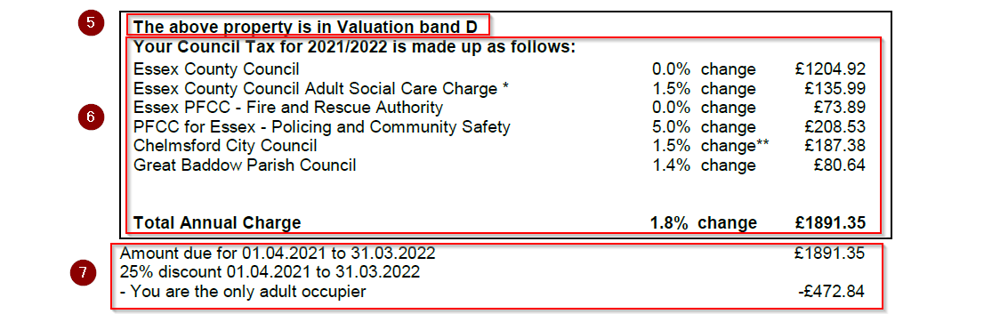

5. This is the band the Valuation Office Agency has assigned to your property. If you have any questions about your banding, you need to contact the Valuation Office Agency.

6. This section shows the individual elements that make up your bill, which adds up to the total annual charge for the property. It includes the Adult Social Care precept. The percentage figure is how much the bill has changed from the previous year.

7. This shows the total annual charge minus:

- discounts that we have applied to your account (such as Single Person Discount)

- any Council Tax Reduction Benefit you may have claimed

- payments you have already made

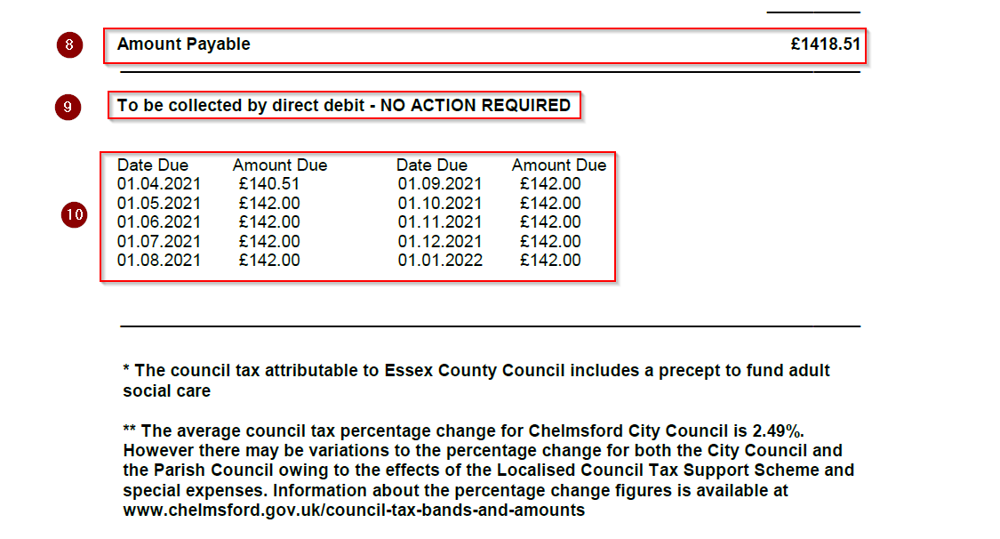

8. This shows the balance you need to pay for the current financial year (April to March). This is the total annual charge, minus any discounts

9. This shows how you pay your bill (such as by Direct Debit)

10. This two-column list shows all the instalments you need to pay, and when you have to pay them